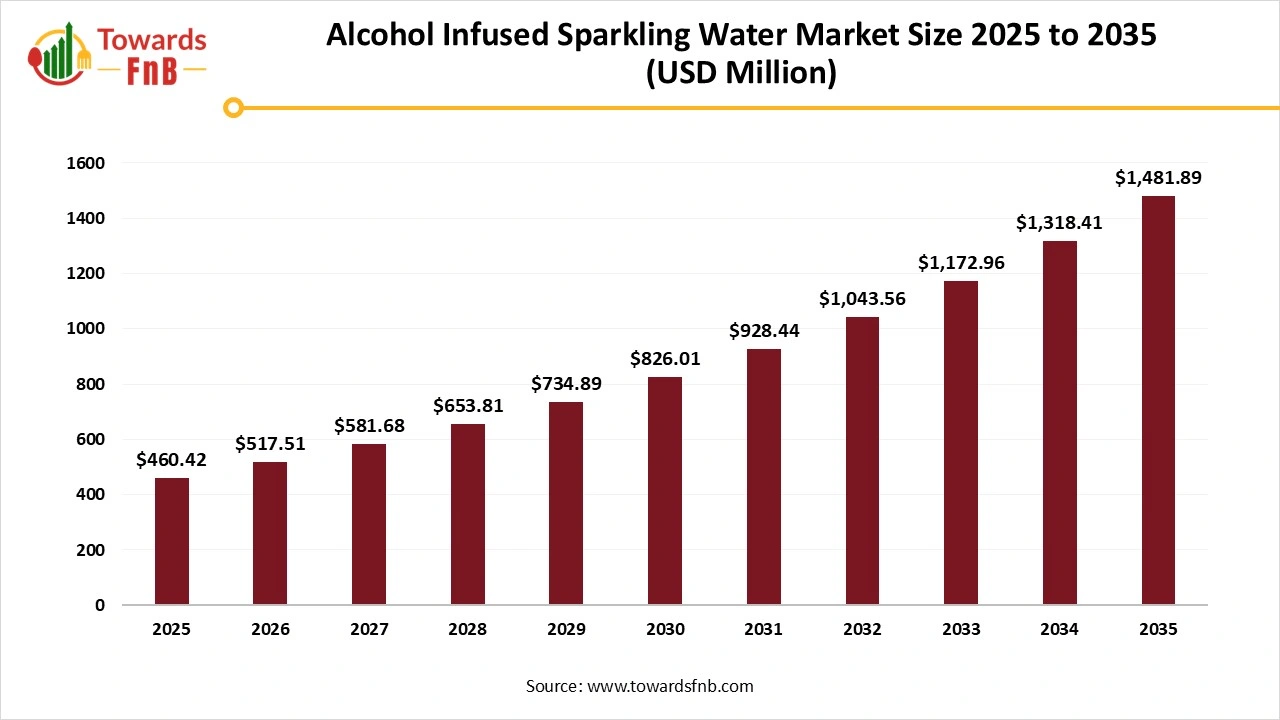

Ottawa, Jan. 20, 2026 (GLOBE NEWSWIRE) -- The global alcohol infused sparkling water market size stood at USD 460.42 million in 2025 and is predicted to grow from USD 517.51 million in 2026 to reach around USD 1,481.89 million by 2035, as reported by Towards FnB, a sister firm of Precedence Research. This growth trajectory highlights increasing investments by beverage manufacturers, expanding retail penetration, and rising innovation in flavors, formulations, and packaging formats.

The market is observed to grow due to higher demand for non-alcoholic beverages, a growing population of health-conscious consumers, and a growing population of young consumers seeking refreshing and socially appealing options.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5978

Key Highlights of Alcohol Infused Sparkling Water Market

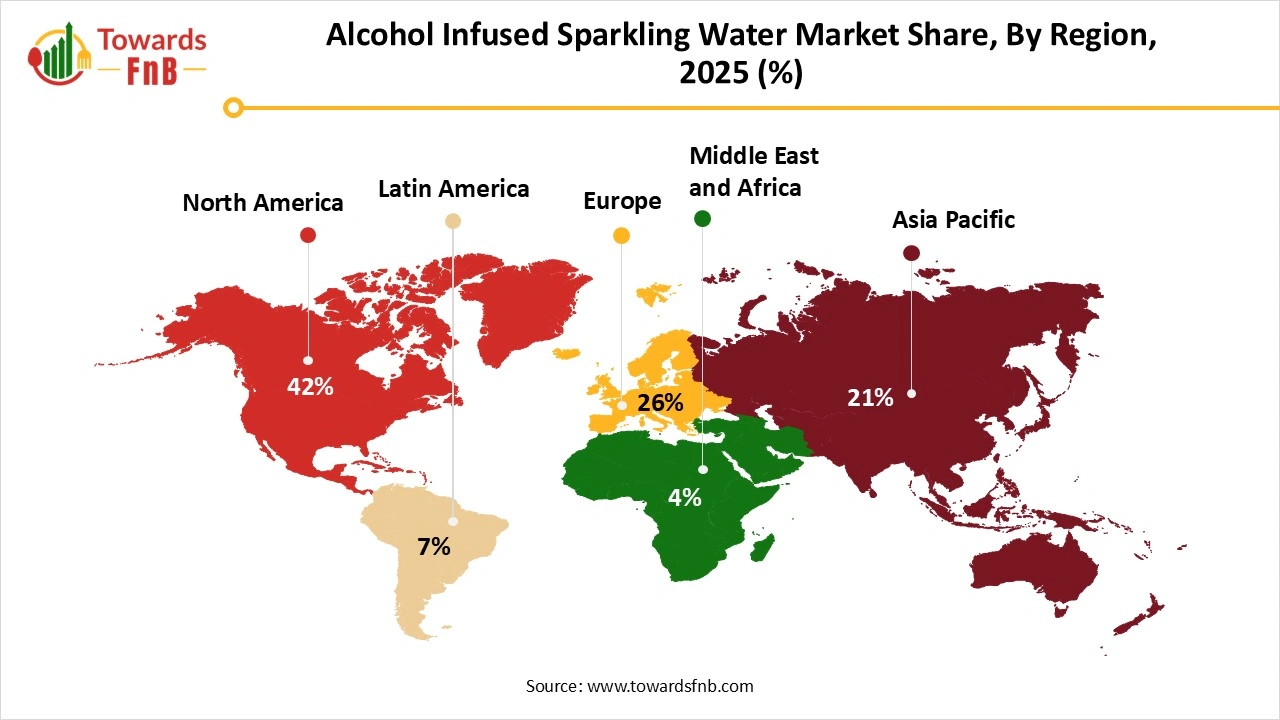

- By region, North America led the alcohol infused sparkling water market with largest share of 42% in 2025.

- By region, the Asia Pacific is expected to grow in the foreseeable period.

- By distribution channel, the off-premise segment led the alcohol infused sparkling water market in 2025.

- By distribution channel, the on-premises segment is expected to grow in the foreseen period.

- By end user, the offline sales segment dominated the alcohol infused sparkling water market in 2025.

- By end user, the online sales segment is expected to grow in the foreseeable period.

“Alcohol-infused sparkling water is no longer a niche hard-seltzer extension, it has become a structurally important category redefining social drinking,” said Vidyesh Swar, Principal Consultant at Towards FnB.

“Health-conscious Millennials and Gen Z consumers are actively choosing low-ABV, clean-label, and functional-aligned alcoholic beverages, creating sustained long-term demand across both premium and mass-market segments.”

Growing Health Consciousness Aiding the Growth of Alcohol Infused Sparkling Water Industry

The alcohol infused sparkling water market is observing growth due to higher demand for low-calorie, low-sugar, and healthier alcoholic alternatives. The market deals with carbonated drink options with added alcohol, such as fermented spirits or malt/sugar, offering convenient, flavored, and low-calorie alternatives. Hence, such options are also suitable for millennials and GenZ in search of refreshing and non-alcoholic options.

The market also observes growth due to the availability of healthier options driven by factors such as rising innovation in formulations, such as lower ABV and natural flavors. Such options are an ideal refreshing alcoholic alternative for health conscious consumers. Consumers in search of healthier, gluten-free, and real-fruit flavor-infused options also help to fuel the growth of the market. Easy availability of such products on various platforms is another major factor propelling the growth of the market.

Technological Innovations Aiding the Growth of the Alcohol Infused Sparkling Water Market

Technological advancements in the form of smart branding, use of sustainable methods like zero-waste and eco-packaging, automation, digitalization, enhanced production efficiency, and AI-driven flavor creations help to fuel the growth of the market. Innovation in functional ingredients, streamlined e-commerce/D2C delivery, precision fermentation, botanicals, and probiotics also help to fuel the growth of the market.

AI also helps in quality control and brewing, cost reduction, and unique flavor development, further fueling the growth of the market. Meeting the demands of consumers, such as options like cleaner, healthier, functional, and premium options, helps to fuel the growth of the market. Hence, such factors altogether help to fuel the growth of the market

Impact of AI on the Alcohol Infused Sparkling Water Market

Artificial intelligence is increasingly being applied in the alcohol infused sparkling water market to support formulation optimization, flavor consistency, and demand forecasting in a highly competitive and trend-driven beverage category. Machine learning models are used to analyze consumer preference data, flavor chemistry, carbonation levels, and alcohol-by-volume interactions to design formulations that balance taste neutrality, mouthfeel, and stability while maintaining low-calorie and low-sugar positioning. In product development, AI accelerates flavor iteration by predicting how botanical extracts, fruit essences, and sweeteners systems interact with alcohol and carbonation over shelf life, reducing the need for extended sensory trials. On the manufacturing side, AI-enabled process control systems monitor carbonation pressure, filling accuracy, and alcohol dispersion to ensure batch consistency and regulatory compliance across high-speed canning lines.

AI is also used in demand forecasting and portfolio management, where predictive analytics help producers align SKU mix, packaging formats, and regional launches with seasonal consumption patterns and retail velocity. From a regulatory and compliance standpoint, AI assists in label validation, alcohol classification, and formulation screening by mapping product specifications against alcoholic drinks regulations overseen by the Alcohol and Tobacco Tax and Trade Bureau and food safety frameworks enforced by the U.S. Food and Drug Administration.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/alcohol-infused-sparkling-water-market

Recent Developments in Alcohol Infused Sparkling Water Market

- In June 2025, Brandon Hanson, co-founder of Sonoma Vodka, launched Goodmellow, a functional beverage infused with hemp-derived THC. The brand claims its launch is infused with real flavors, intentional ingredients, and a balanced buzz.

- In September 2025, Kentucky Hop Water announced the launch of its hemp-derived beverage. The new launch features notes of grapefruit and orange peel and is infused with 5mg of federally compliant Delta-9 THC derived from hemp.

New Trends of Alcohol Infused Sparkling Water Market

- Higher demand for non-alcoholic beverages that are available with enriched and fortified nutrients, along with innovative flavor options.

- Higher demand for healthier options, such as low-calorie and low-sugar beverages, also helps to fuel the growth of the market.

- Availability of various flavor options, such as mild as well as bold choices infused with real fruits and ingredients like oranges, chili, and lemons, also helps to enhance the growth of the market.

- Availability of customized, innovative, and unique flavor options and combinations also helps to fuel the growth of the market.

- Higher demand for sophisticated and healthier alternatives to alcohol, suitable for social gatherings, also helps to elevate the growth of the market.

Product Survey of the Alcohol Infused Sparkling Water

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Alcohol Infused Sparkling Water (Malt-Based) | Carbonated water beverages containing alcohol derived from fermented malt bases | Neutral malt base, flavored variants | Ready-to-drink alcohol brands, retail beverage shelves | Malt-based hard seltzers |

| Alcohol Infused Sparkling Water (Sugar-Fermented) | Alcohol produced through fermentation of cane sugar or dextrose for a cleaner taste profile | Sugar-fermented alcohol base, low-carb variants | Premium RTD alcohol producers | Sugar-brewed hard seltzers |

| Spirit-Based Sparkling Water | Sparkling water blended with distilled spirits for controlled alcohol content | Vodka-based, gin-based sparkling waters | Craft beverage brands, on-premise offerings | Spirit-infused sparkling beverages |

| Flavored Alcohol Infused Sparkling Water | Alcoholic sparkling waters enhanced with natural or nature-identical flavors | Citrus, berry, tropical flavor variants | Mass-market and premium seltzer brands | Flavored hard seltzer lines |

| Unflavored or Neutral Seltzers | Minimalist formulations focused on low calories and clean taste | Plain or lightly carbonated variants | Health-conscious consumers, mixability use | Neutral hard seltzers |

| Low-ABV Sparkling Alcohol Waters | Reduced-alcohol formulations targeting moderation trends | Session-strength variants | Lifestyle alcohol brands | Low-ABV hard seltzers |

| Zero-Sugar Alcohol Infused Sparkling Water | Formulated without added sugars or sweeteners | Unsweetened, flavored-unsweetened variants | Low-calorie and keto-positioned brands | Zero-sugar hard seltzers |

| Functional Alcohol Infused Sparkling Water | Products incorporating functional cues alongside alcohol | Electrolyte-infused, vitamin-infused variants | Experimental and niche beverage brands | Functional hard seltzer products |

| Organic Alcohol Infused Sparkling Water | Made using certified organic alcohol bases and flavors | Organic-certified flavor lines | Organic and clean-label alcohol brands | Organic hard seltzers |

| Private Label Alcohol Infused Sparkling Water | Contract-manufactured products for retailers and distributors | Store-brand formulations | Retail chains, beverage distributors | Private-label hard seltzer products |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5978

Alcohol Infused Sparkling Water Market Dynamics

What are the Growth Drivers of the Alcohol Infused Sparkling Water Market?

The growing population of health conscious consumers is one of the major factors for the growth of the market. Hence, it leads to higher demand for options such as low-calorie, low-sugar, and other forms of healthier options. Higher demand for exotic and real-fruit flavor options also helps to enhance the growth of the market. Availability of ready-to-drink and convenient drink options, helpful for consumers with a hectic schedule, also helps to fuel the growth of the market. Rising disposable income, leading to higher demand for premium and customized options, also helps to fuel the growth of the market. Easy availability of different types of alcohol infused sparkling water on various platforms also helps to fuel the growth of the alcohol infused sparkling water market.

Regulatory Hurdles Impacting the Growth of the Alcohol Infused Sparkling Water Industry

Managing major alcohol laws, tax structures, and labeling requirements in different regions is one of the major factors disturbing the growth of the market. Keeping a tap on such rules and regulations and following them may turn out to be a costly and slow procedure, further affecting the market’s growth. A few areas also have partial alcohol bans and ‘dry days’ to be followed, restricting the growth of the market.

Growing Health and Wellness Trends are helpful for the Growth of the Alcohol Infused Sparkling Water Market

The growing population of health and wellness-conscious consumers is one of the major opportunities for the growth of the market. Such consumers highly demand low-calorie and low-sugar options, further propelling the market’s growth. Higher demand for exotic and natural fruit-flavor infused options is an ideal alternative to alcoholic drinks, further hampering the growth of the market. Higher demand for quality flavors, premium ingredients, and fortified options also helps to enhance the growth of the market. Such drinks are also an ideal option for alcohol, and are also light and refreshing for social occasions, fueling the growth of the market.

Alcohol Infused Sparkling Water Market Regional Analysis

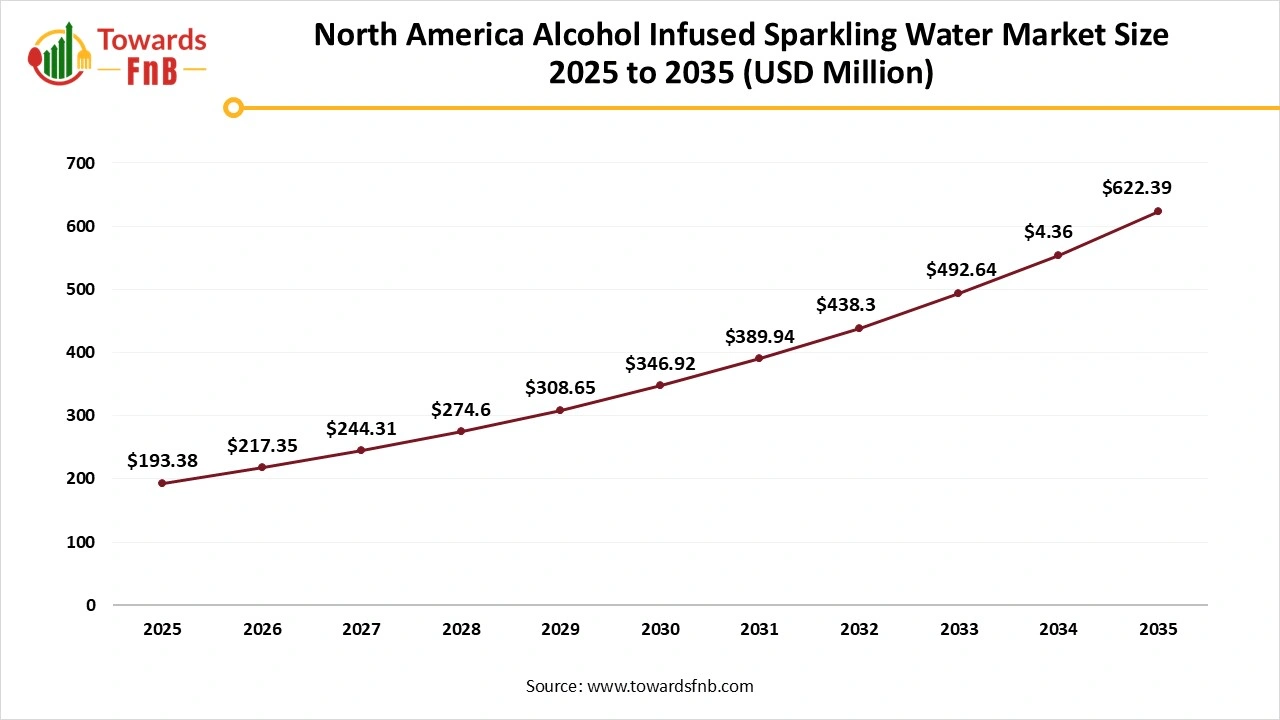

North America led the Alcohol Infused Sparkling Water Market in 2025

North America dominated the alcohol infused sparkling water market in 2025 due to the growing population of health conscious consumers in the region, leading to higher demand for low-sugar and low-calorie options. Higher demand for convenient and ready-to-drink options also helps to enhance the growth of the market. Consumers in the region highly demand exotic and fresh fruit flavor options, which are attractive for consumers and helpful for the growth of the market.

Higher shift of consumers towards gluten-free and healthier options, such as hybrid seltzers and vodka-based seltzers, also helps to fuel the growth of the market. The US has a major contribution in the growth of the market due to higher demand for healthier, flavorful, and innovative alcohol infused sparkling water choices.

Asia Pacific is observed to be the fastest-growing region in the Foreseen Period

Asia Pacific is observed to be the fastest growing region in the foreseen period due to factors such as growing disposable income, rising health and wellness trends, and rapid urbanization. The market also observes growth due to the availability of different types of healthier alcohol infused sparkling water in low-sugar, low-calorie, and gluten-free options, fueling the growth of alcohol infused sparkling water market in the foreseeable period. India has a major contribution to the growth of the market due to growing disposable income, changing consumer lifestyles, and higher demand for premium and standardized products, fueling the growth of the market.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth in the foreseen period due to higher demand for healthier options that are low in calories, gluten-free, and low in sugar. Rising health and wellness trends, along with higher demand for exotic and natural fruit-flavor options, also help to fuel the growth of the market. Germany has a major contribution to the growth of the market due to the higher demand for innovative flavors that are easily available on various platforms in the region.

Trade Analysis for the Alcohol Infused Sparkling Water Market

What Is Actually Traded (Product Forms and HS Proxies)

- Alcohol-infused sparkling water beverages, typically containing fermented alcohol or distilled spirits blended with carbonated water, are commonly traded under HS 2206 (other fermented beverages) when produced via fermentation.

- Spirit-based ready-to-drink sparkling beverages, where alcohol is derived from distilled spirits such as vodka, are generally classified under HS 2208 when the alcoholic component defines the product.

- Malt-based hard seltzers, produced using fermented malt bases, are often declared under HS 2203 or HS 2206 depending on national customs interpretation.

- Flavor concentrates and alcohol bases supplied separately for local blending and carbonation are typically traded under HS 2106 or HS 3302 depending on composition.

- Bulk alcoholic bases for contract bottling, used by beverage brands to localize production, are usually cleared under HS 2207 or HS 2208.

Top Exporters (Supply Hubs)

- United States: Major exporter of branded hard seltzers and alcohol-infused sparkling waters supported by large-scale RTD beverage production and brand-led distribution.

- Canada: Exporter of malt- and spirit-based sparkling alcoholic beverages benefiting from established alcoholic beverage manufacturing and access to North American markets.

- United Kingdom: Exporter of premium alcohol-infused sparkling beverages aligned with RTD innovation and private-label production.

- Australia: Exporter of hard seltzers and low-alcohol sparkling beverages supported by domestic alcohol production and brand experimentation.

Top Importers (Demand Centres)

- United States: Significant importer of premium and niche alcohol-infused sparkling waters to complement domestic brand portfolios.

- European Union: Strong intra-EU and extra-EU imports driven by RTD category expansion and diversification of low-calorie alcoholic beverages.

- Japan: Imports flavored alcohol-infused sparkling beverages aligned with convenience retail and RTD consumption trends.

- South Korea: Growing imports linked to premiumization and rising demand for low-alcohol ready-to-drink beverages.

Typical Trade Flows and Logistics Patterns

- Finished canned or bottled beverages are shipped via containerized sea freight with attention to carbonation integrity and packaging durability.

- Regional contract manufacturing and co-packing are widely used to reduce freight costs and comply with local alcohol regulations.

- Bulk alcohol bases may be shipped separately and blended locally with carbonated water and flavors.

- Distribution often relies on alcohol-specific logistics networks and licensed importers.

Trade Drivers and Structural Factors

- Growth in ready-to-drink alcoholic beverages sustains cross-border trade in hard seltzers.

- Demand for low-calorie and low-sugar alcohol options drives product diversification.

- Brand-led innovation cycles encourage test launches across multiple markets.

- Regulatory differences influence whether finished beverages or bulk alcohol bases are traded.

- Packaging efficiency and shelf stability support long-distance distribution.

Regulatory, Quality, and Market-Access Considerations

- Alcohol-infused sparkling water is subject to national alcohol laws governing taxation, labeling, and permitted alcohol sources.

- Classification as beer, fermented beverage, or spirit-based drink affects tariffs and market access.

- Labeling requirements covering alcohol content, ingredients, and health warnings are mandatory.

- Importers must hold appropriate alcohol licenses and comply with excise control systems.

Government Initiatives and Public-Policy Influences

- Alcohol taxation structures and excise regimes strongly influence trade competitiveness.

- Public health alcohol policies affect product positioning and market access conditions.

- Trade facilitation agreements and customs harmonization impact cross-border beverage flows.

Alcohol Infused Sparkling Water Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 12.4% |

| Market Size in 2026 | USD 517.51 Million |

| Market Size in 2027 | USD 581.68 Million |

| Market Size in 2030 | USD 826.01 Million |

| Market Size by 2035 | USD 1,481.89 Million |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Alcohol Infused Sparkling Water Market Segmental Analysis

Distribution Channel Analysis

The off-premise segment led the alcohol infused sparkling water market in 2025, due to factors such as higher demand for consumption of healthier alcoholic alternatives at home, higher disposable income, and a major shift in consumer preferences. The segment also observes growth due to the easy availability of such healthier choices at lower prices, which also helps in fueling the growth of the market. The segment also provides a variety of flavor options and products in different quantities, fueling the growth of the market.

The on-premises segment is expected to grow in the foreseen period due to the convenience provided by the online platforms, fueling the growth of the market. Online platforms also provide multiple other services such as quick home delivery, a huge product portfolio, and detailed information and reviews of different products, which are helpful for the growth of alcohol infused sparkling water market in the foreseeable period.

End Use Analysis

The offline sales segment led the alcohol infused sparkling water market in 2025, as the segment allows consumers to buy such products easily, and in case of impulse purchases. Easy availability of such products in the nearby supermarkets or liquor shops also helps to fuel the market’s growth. Such stores also have a variety of other options in various flavors and in packages of different quantities, fueling the growth of the market. Huge displays depicting the availability of new products and new flavors are also a major factor fueling the growth of the market.

The online sales segment is expected to grow in the foreseeable period due to higher demand for different types of alcohol infused sparkling water in different flavor options. Higher demand for healthier options that are low in sugar, low in calories, and gluten free also helps to fuel the growth of the market. Such platforms also have ideal options for consumers searching for light and refreshing options that are perfect for after-office get-together cultures or for elite social gatherings.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies of Alcohol Infused Sparkling Water Market

- Asahi Group Holdings Ltd.

- Brown-Forman Corp.

- Carlsberg A/S

- Coca-Cola Co.

- Diageo Plc

- E. & J. Gallo Winery

- Heineken NV

- Kirin Holdings Co. Ltd.

- Mark Anthony Brands

- Molson Coors Beverage Co.

- Naked Collective Ltd.

- PepsiCo Inc.

- Pernod Ricard SA

- Phusion Projects LLC

- Polar Beverages

- Suntory Holdings Ltd.

- White Claw Seltzer Works

Segments Covered in the Report

By Distribution Channel

- On-Premise

- Off-Premise

By End-User

- Online Sales

- Offline Sales

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5978

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market